In the Global Startup Ecosystem Index, before we present the results, we introduced a section that gives an overview of the current state of the Global Startup Ecosystem, which begins with the Global Startup Economy Update.

It is evident that 2021 gave rise to a startup valuation bubble which is currently undergoing a major recalibration in valuations for both private and publicly traded startups. The majority of startups that recently became public via IPO are trading much lower than their initial price, some have decreased up to 90% of value, demonstrating the depth of the current downturn and lack of appetite for risky assets.

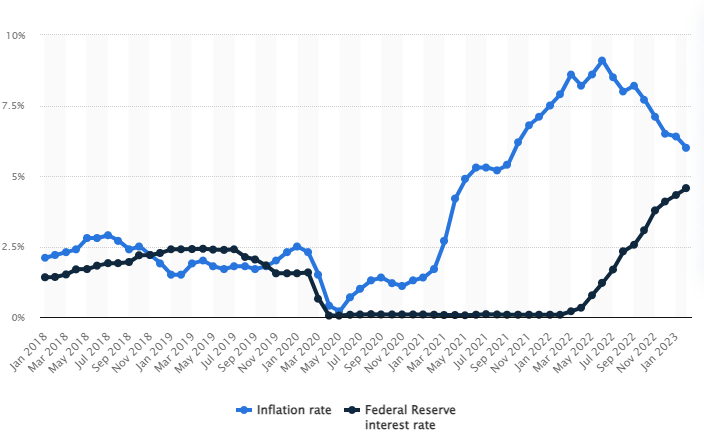

The government subsidies and free money injected into the market, in combination with historically low (and sometimes negative) interest rates to combat the negative effects of the COVID-19 pandemic, accelerated the creation of this bubble. Rising inflation, followed by a rapid increase of interest rates, had a severe impact on startups, as the risk associated with investing in this volatile asset class of mainly non-profitable companies has surged. Thus, startups are now compelled to prioritize profitability, and set aside models that prioritize growth. As funding is becoming less accessible to founders, many are now opting to bootstrap their ventures.

The general expectation is that as long as interest rates stay high, more and more startups will run out of money, and we will enter a winter period of startup funding. This should not discourage entrepreneurs, as some of the most successful tech companies, such as Meta and Alphabet, were established and expanded in times of crisis.

The following are some of the most impactful economic events that influenced the global startup ecosystem over the last 12 months:

Decline of Startup Funding

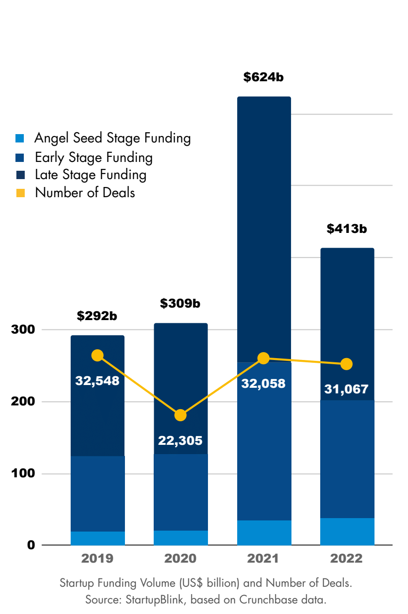

Startup Funding Volume (US$ billion) and Number of Deals

After experiencing a record year in 2021, global startup funding in 2022 declined by more than 30%. Although this number is still higher than in 2020 and 2019, most of the decline occurred in the second half of 2022, signaling an accelerating downturn in the investment ecosystem. When it comes to the number of startup funding deals, Crunchbase data shows that this number only declined by around 3%, from 32,058 deals in 2021 to 31,067 in 2022. This indicates a substantial decrease in the ticket size, which was US$ 19.5 million in 2021 and 13.3 million in 2022. In this difficult investment climate, founders will need to change their mindset: this year, early revenue is more important than massive growth.

It is interesting to see that angel-seed investment had a slight increase in 2022. This shows the resilience of early stage investment compared to later stages which are more correlated with the massive decrease of value in publicly traded tech companies. Late stage investments registered a 43% year-over-year fall.

The real story is in the initial numbers of 2023. According to Crunchbase, global funding in the first quarter is at US$ 76 billion, a 53% decline from the US$ 162 billion in the first quarter of 2022. If we remove the massive investment done in both OpenAI and Stripe in Q1 2023, the decrease would be a whopping 63%. Tough times are ahead.

The collapse of the Silicon Valley Bank

As if the massive downturn in investments was not enough, startups were hit by another shocking surprise with the collapse of the Silicon Valley Bank. As reported by Crunchbase, the bank had relationships with over 50% of the VCs in the US, but the effects of the collapse have been felt around the world. Fortunately, the US government has been quick to guarantee the assets of every deposit in the bank, and prevented a massive shockwave with implications that could have been historical on the global startup ecosystem and VC industry. Regardless, startups received an important wake up call about the need to diversify their assets and respond with agility to any crisis as it evolves.

Unicorns losing their celebrated status? Not yet.

The curious case of unicorns shows that the real impact of the downturn has still not fully materialized in private sector startup valuations. Publicly traded former unicorns have lost substantial value, and some high valuation startups such as Stripe, Klarna, and Instacart have already raised money in a downround (valuation lower than the previous round of investment). However, the number of unicorns (privately held startups valued at above US $1 billion) has not significantly changed.

On the contrary; The number of unicorns has steadily grown over the years, with 80% growth in 2021 and 67% in 2022. However, in the last year we have witnessed a slowdown of only 8.49% growth in unicorns. This means that unicorns are still being created, but at a much slower pace compared to previous years. Unicorns and startups will avoid a downround as much as they can, as this has a demoralizing effect on the team and investors, and might also cost them their unicorn status. However, considering that 20% of unicorns are right at the US$ 1 billion mark as of April 2023, we expect many unicorns to lose their status as they will be forced to raise more investment soon, especially considering many of them are not profitable yet. Some estimates forecast at least 50% of the current 1,100+ unicorns around the world will lose their status if they attempt to raise money in the current environment.

IT Sector Layoffs

While the global employment situation remained stable, we saw an increased trend of layoffs in IT and startup sectors. Since these rounds of layoffs are mainly impacting the Tech sector, they are further deflating the allure of startups and their impact and share of the economy, even after years of startups being one of the most prominent sectors in the global economy. According to Layoffs.fyi, almost 200,000 people were laid off in the IT sector in the first 4.5 months of 2023. This number already surpassed the 164,591 layoffs recorded for the whole year in 2022. As global tech giants such as Google, Meta, and Microsoft began their workforce reductions, many companies followed in their footsteps.

Download the Global Startup Ecosystem Index to discover the current state of the Global Startup Ecosystem

About Us:

StartupBlink is the world’s most comprehensive startup ecosystem map and research center, working with over 100 government entities worldwide. StartupBlink’s global startup ecosystem map has tens of thousands of registered startups, coworking spaces, and accelerators, creating a robust sample of innovation globally.

Our Partners: