New industries receive the spotlight even in the midst of an IT sector crisis, showing that investors are still active in the market, as long as they can focus on startup industries that seem to be on the rise. At the same time, some industries that have been historically popular are now being swept off the stage. As the widespread joke goes, all web3 experts became AI experts this year. This blog expands on the current state of the global startup ecosystem section of the Global Startup Ecosystem Index Report, highlighting the latest startup industry trends in 2023.

The Rise of AI

In the past year, we have seen an extraordinary leap in AI capabilities. Unlike Web3 and the metaverse, which were unused by most of us, AI is becoming integrated in our lives with ChapGPT, and applications such as Midjourney and Lensa.

Beyond increased interest from the public, we are also going through the fast adoption of AI solutions by both companies and governments. This year, it was reported that Microsoft invested US$ 10 billion in OpenAI, building on its historic investment which started in 2019. According to the International Data Corporation (IDC), the spending on artificial intelligence is expected to reach US$ 120 billion by 2025 in the US alone, disrupting jobs while bringing many positive aspects to our lives, and hopefully without destroying humanity in the process.

It remains to be seen whether the industry will keep this momentum, as concerns abound about how policies such as the EU’s Artificial Intelligence Act may hinder the progress and innovation of the industry. On the other hand, there are a significant number of proponents who support implementing regulations within the industry to ensure progress is achieved in a responsible and controlled manner.

Diminished Interest and meltdowns in Web 3.0

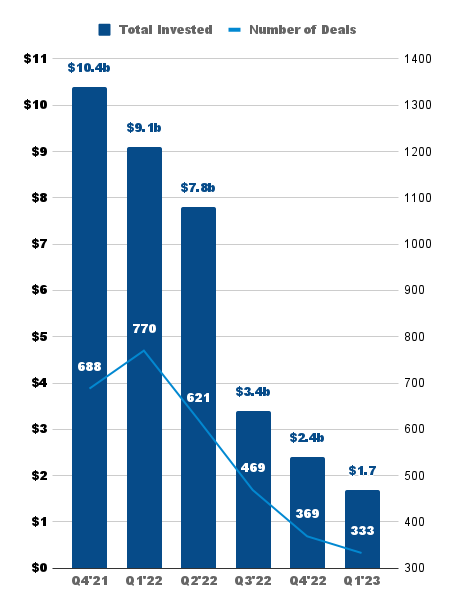

Funding To VC-backed Web3 Startups (US$ billion)

Despite the initial enthusiasm for blockchain technologies and their use in cryptocurrency and NFTs, the Web3 (Web 3.0) industry experienced nothing short of a collapse. Data from Crunchbase shows that the decline in funding for Web3 in 2022 was significantly steeper than the decline across all startup industries. However, in terms of venture funding for this industry, 2022 was still a much better year than 2020 with the investment totaling about US $21.5 billion compared to US$ 4.8 billion in 2020. 2022 and 2023 saw the collapse of Signature Bank and other banks with friendly policies for crypto, as well as the downfall of one of the largest global cryptocurrency exchanges, FTX. In addition, Chainalysis noted that 2022 was a record year for crypto hacking, as US$ 3.8 billion worth of cryptocurrency was stolen.

In this context, startups in the Web3 industries are faced with a rough year in 2023. It is left to be seen if Web3 can retake the stage, but in order to do so, a cleanup of bad players is needed to restore public trust. Many talented entrepreneurs and coders have shifted their attention from Web3, and for the industry to continue growing talent has to return to developing real applications that solve real problems, instead of focusing on the fads and get rich schemes that have been prevalent in the industry.

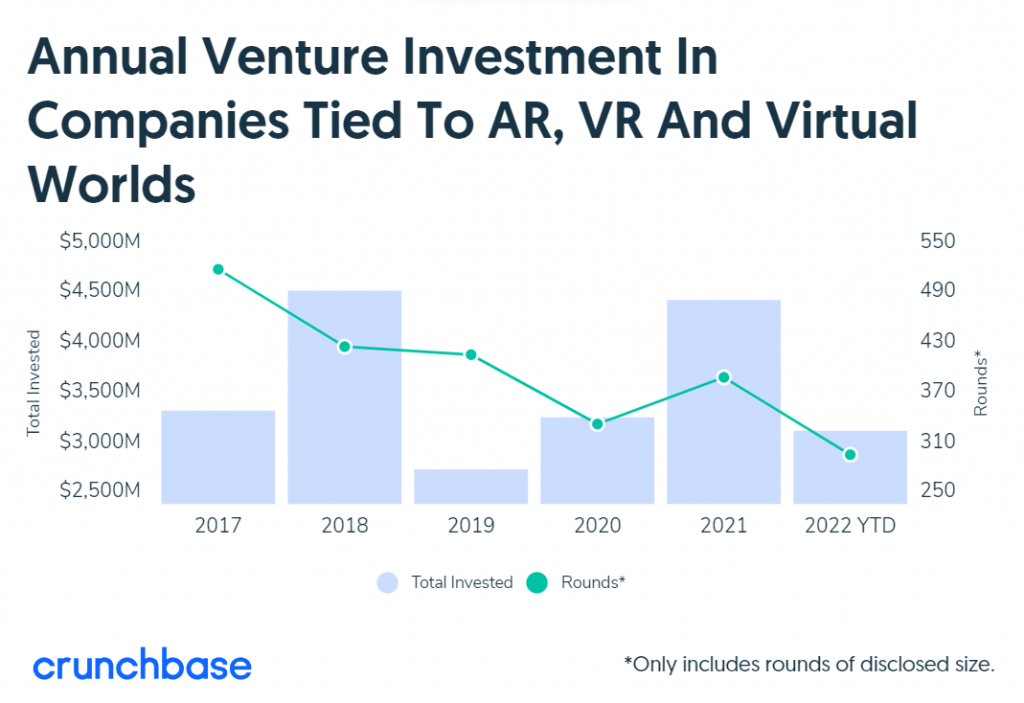

The Downturn in Metaverse and VR

It is now clear that the bet on the Metaverse and VR as the next game changer was premature. Although the potential for extraordinary innovation is still there, the industry as a whole did not manage to offer solutions that will truly be integrated into the economy and create mass adoption of their technologies. Meta has recognized this and reported it will cut more jobs connected to the Metaverse project to focus on AI. Crunchbase data also indicates that annual venture investment in VR and AR collapsed in 2022, following the downward trend in overall global venture funding.

Climate Tech Surge

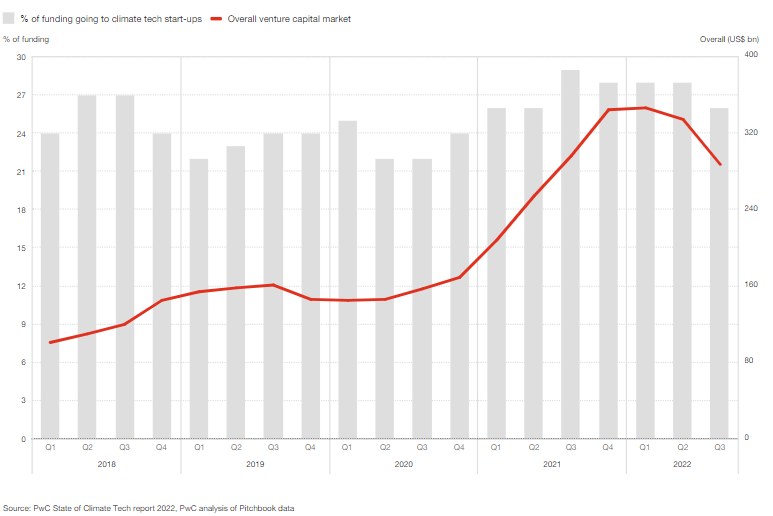

Share of Global Venture Funding Going Toward Climate Tech Startups (US$ billion)

According to PwC’s State of Climate Tech 2022, the funding for climate tech accounted for over 25% of all venture capital investments made last year. The sector also saw a surge in the number of deals from 2021 to 2022, even as global startup deals dropped across other industries. Climate tech was not spared from some negative trends, such as the decline of the number of and total value of deals, however, on the macro level, the trends in this industry seem positive as governments channel massive amounts of resources and incentives transitioning to zero emissions.

Rise in Semiconductors

Geopolitical shifts and increased risks have given more traction to some industries of heightened strategic importance.

The global semiconductor industry is projected to grow from US$ 1 trillion in revenues by 2030, which would mean a doubling in revenue over a decade, according to Deloitte’s Semiconductor industry outlook 2023. We are already seeing the strategic importance of this industry for countries such as the US, Taiwan, and China, as well as the EU. After the introduction of the US CHIPS Act in August 2022, investment into the country’s production of semiconductors started pouring in, with a staggering US$ 200 billion in private investments. According to the Semiconductor Industry Association (SIA), there are 50 new semiconductor ecosystem projects announced across the US and 44,000 new high-quality jobs in the sector.

The US is not the only country allocating strategic importance to this industry; the Dutch and British governments have been scaling their capabilities in the field. Much of the Taiwan crisis and the incentives revolving around it are influenced by the massively successful TSMC, which has a global market share of more than 50%. Semiconductors are critical to all civilian and military uses, and we will see more focus on this sector in the future.

Download the Global Startup Ecosystem Index to discover the latest trends in the global startup ecosystem

About Us:

StartupBlink is the world’s most comprehensive startup ecosystem map and research center, working with over 100 government entities worldwide. StartupBlink’s global startup ecosystem map has tens of thousands of registered startups, coworking spaces, and accelerators, creating a robust sample of innovation globally.

Our Partners: