Abstract

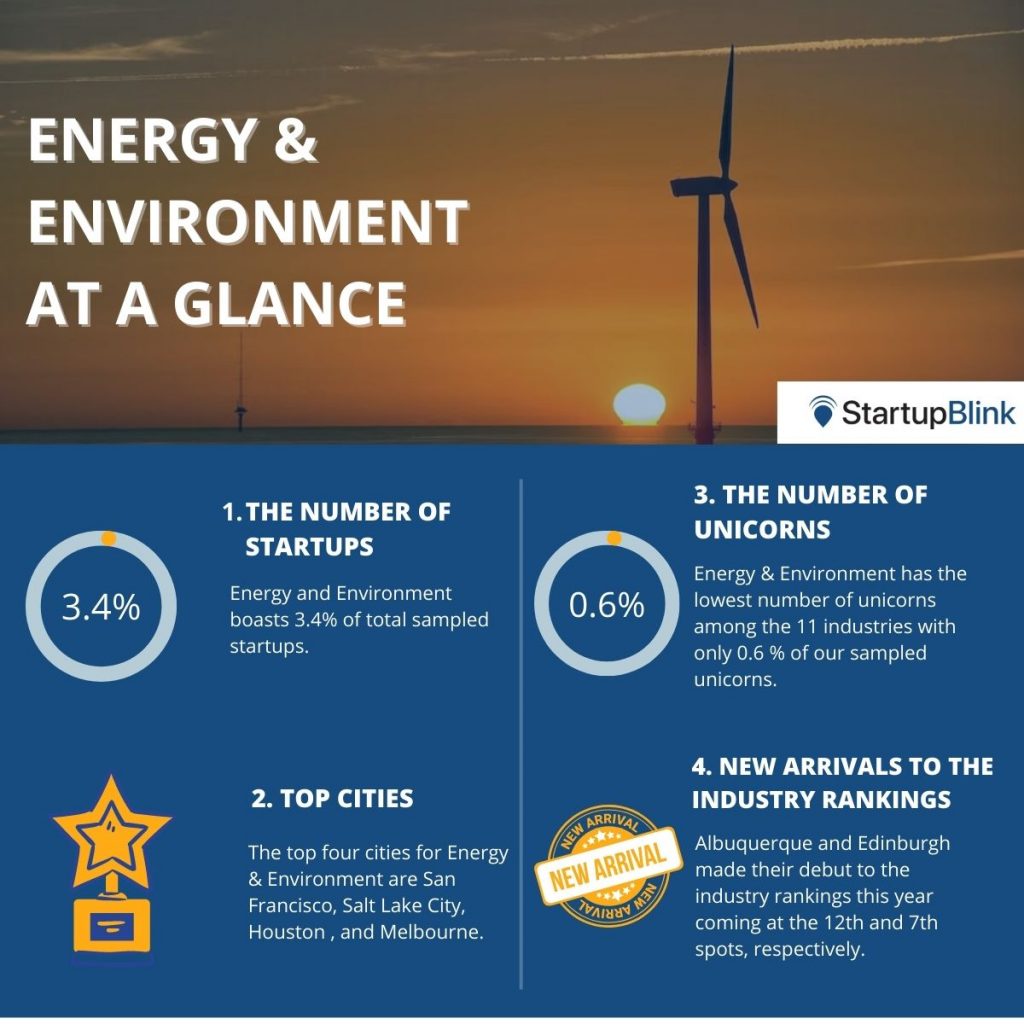

This report depicts the state of the Energy & Environment industry in 2022 from the perspective of startups. Providing an in-depth analysis of the top 30 cities for Energy & Environment, this report expands on the findings of StartupBlink’s Global Startup Ecosystem Index Report 2022. The Energy & Environment industry represented the smallest sample of startups and unicorns in 2022.

Energy and Environment Industry at a Glance: top insights

➡️In StartupBlink’s GSEI 2022, Energy & Environment is the smallest industry, with 3.4% of our sampled startups and 0.6% of our sampled unicorns.

➡️The Energy & Environment industry has six subindustries with the biggest being Energy (36.81%), CleanTech (21.03%), and Clean Energy (19.72%).

➡️United States dominates the top 30 destinations for Energy & Environment startups, boasting 13 overperforming ecosystems in the industry.

Ranking the top 30 Cities for Energy & Environment

Top positions in 2022 Energy & Environment rankings are dominated by the US cities; San Francisco, Houston, Salt Lake City, and followed by Australian City Melbourne and German City, Berlin. The first two cities, San Francisco and Houston maintained their rank, just like in 2021. However, the remaining three cities arrived in the Top 5 in 2022. Especially, Salt Lake City and Melbourne made a jump of 54 spots and 29 spots in the 2022 industry rankings.

Several other cities deserve special mention for their impressive performance in the Energy and Environment industry. Rome and Albuquerque stand out for their significant differences between their global and industry rankings, with Rome coming in 128 spots higher and Albuquerque at 125 spots higher. Edinburgh and Calgary also made significant jumps compared to their global rankings, with 89 and 77 spots respectively. Houston, Melbourne, Dublin, and Vancouver may not have made as dramatic of a jump as some of the other cities, but they should still be celebrated for ranking 47, 38, 35, and 34 spots higher in the Energy and Environment industry, respectively. On the other hand, New York, Los Angeles, and Boston are underperforming in the industry ranking 15, 14, and 14 spots lower, respectively.

Similarly to Salt Lake City, Rome, Dublin, and the Tokyo-Yokohoma Area have also seen significant increases in their rankings compared to 2021. In 2022, Rome rose 75 spots, Dublin climbed 53 spots, and the Tokyo-Yokohoma Area rose 39 spots in the Energy and Environment industry. These are impressive achievements that should be celebrated. Another notable achievement is Albuquerque’s entry into the Energy and Environment industry rankings for the first time, coming in at 12th place. In contrast, Moscow, Seattle, and Chicago saw a decrease in their rankings compared to 2021, falling 22, 14, and 13 spots, respectively.

Energy& Environment Unicorns in 2022

Unicorns are startups that reach a valuation of one billion dollars or above. Below are the highest-ranked Energy & Environment unicorns from the StartupBlink database.

Herzliya, Israel

StoreDot is a battery developer and materials innovation leader, developing battery technologies for electric vehicles.

Carson City, United States

Redwood Materials is a startup company that specializes in recycling batteries and creating sustainable materials for use in circular supply chains, with a focus on electric vehicles.

San Francisco, United States

EcoFlow is a company that creates environmentally friendly and cost-effective portable power stations for both personal and professional use.

Berlin, Germany

Enpal is a company that provides solar panel systems for homeowners to generate electricity from sunlight.

Hanover, United States

Dragos is a cybersecurity company focused on protecting critical infrastructure in order to secure society. The company works with industrial clients to prevent cyber threats and keep critical systems safe.

Energy & Environment Exits in 2022

An exit for a startup occurs when the founder sells the company’s ownership to an investor or another company. It is a strategy for many startups that have been decided on since their establishment. Here are the top exits in 2022 for the Energy & Environment industry according to the StartupBlink database:

Barcelona, Spain

Wallbox is a global company, dedicated to changing the way the world uses energy in the electric vehicle industry.

Albuquerque, United States

Array Technologies focuses on designing and manufacturing solar tracking equipment.

Stockholm, Sweden

re:newcell’s recycling technology dissolves used cotton and other cellulose fibers and transforms them into a new, biodegradable raw material.

Houston, United States

Sunnova is a leading national residential solar company.

Vancouver, Canada

Alterra Power Corp is a power generation company that specializes on geothermal power, hydropower, and solar power.

Edinburg, United Kingdom

Green Investment Bank was created to invest in green projects on commercial terms and mobilize other private sector capital.

Houston, United States

Oasis Midstream Partners own, develop, operate, and acquire a diversified portfolio of midstream assets.

New Delhi, India

Orange Renewable is a developer and operator of renewable energy projects.

San Jose, United States

QuantumScape is a renewable energy company that develops solid-state battery technology to increase the range of electric cars.

Rome, Italy

RTR is a solar platform owning 134 utility-scale photovoltaic plants across 15 Italian regions with a total capacity of 334 MW.

Notable Energy& Environment Startups

Dallas, United States

Star Oil and Gas is an oil and gas exploration company that provides natural oil and gas services.

Spånga, Sweden

Ferroamp Elektronik develops, manufactures, and markets innovative power electronics for more efficient use of electrical energy.

Jakarta, Indonesia

PT Geo Dipa Energi is a geothermal Energy Company through Geodipa Personnel, Operational Excellence, and Sustainable Growth.

Sunnyvale, United States

Bloom Energy produces a solid-oxide platform for the distributed generation of electricity and hydrogen production.

Saint-Genis-Pouilly, France

PlanetWatch uses advanced technologies, and environmental monitoring worldwide and helps protect public health.

Rome, Italy

Selectra Italia is an information website on energy bills in Italy and an e-shop for power and gas-related services.

San Francisco, United States

EcoFlow Tech designs, develops, and manufactures eco-friendly and affordable portable power stations for personal and professional use.

London, United Kingdom

Bulb provides affordable renewable energy for homes and businesses.

San Diego, United States

SDG & E provides safe and reliable energy service to millions of customers in San Diego and southern Orange counties.

Santa Monica, United States

Rayton Solar utilizes a proprietary technology to manufacture solar panels cheaper and more efficiently than the market standard.

Methodology

To ensure that the rankings are as accurate as possible, we have based our algorithm on objective, quantifiable data that can be comparatively measured across regions, countries, and cities. We refrained from using subjective tools such as surveys and interviews, and instead utilized data that was either accumulated directly from the StartupBlink map or has arrived from integration with a reliable global data partner. We allow as few assumptions as possible regarding cause and effect and focus on one thing: measuring results. We avoid relying on any theoretical models assuming the causes of success for startup ecosystems.

Every year our algorithm is more accurate, and it should be noted that the momentum change of each ecosystem is not only influenced by its achievements over the last year, but also by these algorithm improvements. We have been sampling startup ecosystem data on the curated and interactive StartupBlink Global Map, which enables us to test and perfect our algorithm based on vast sets of data. We estimate that the core map dataset has a representative sample covering 10-15% of total relevant entities in global startup ecosystems. In addition, hundreds of thousands of entities and data integrations are taken into account via our global data partners. Each location’s final score is based on the exact same algorithm. However, we are aware that our sample size fluctuates depending on location and data sourcing. Our only intervention in the score is discounting locations where we determined that the sample size of the entities is higher than average. In order to solve issues with lower than average sample size, we have partnered with approximately 100 Ecosystem Partners, most of which are Government agencies, many of them in locations where our data is limited. We offer all governments administrative access to curate the dataset of their ecosystems, at no cost, granting them complimentary access. On our rankings with Unicorns and Exits, we take into account the valuation of each startup and add some special filters to exclude government entities and corporate spin-offs.

The Methodology used in the 11 industry rankings, including Software and Data, is identical to the algorithm of the global rankings, while taking into account the startup database of each industry. However, the fintech Industry rankings are built on an official Fintech Ecosystem Portal: Findexable’s Global Fintech Map, which includes deeper algorithm changes that are customized according to the specific characteristics of the fintech industry.

Our Data Partners: