In today’s interconnected world, the location in which a startup chooses to establish itself can significantly impact its chances of success. While innovative ideas, strong teams, and a viable business model are essential, the regional context in which a startup operates can provide resources, support networks, and market opportunities for growth. Understanding the best regions for startups is vital for entrepreneurs seeking to expand, investors looking to maximize their returns, and policymakers aiming to foster vibrant entrepreneurial ecosystems.

In this blog article, we delve into the best startup regions, providing insights on momentum changes, funding, and rankings from the Global Startup Ecosystem Index 2023 to help you make informed decisions and navigate startup ecosystems effectively. If you would like to dive deep into the full data of our research, StartupBlink Pro grants access to the full data behind the Index.

Power Shifts and Regional Momentum

Gain access to the regional ranking tables of 1,000 cities and 100 countries with StartupBlink Pro.

It’s crucial to analyze the distribution and momentum of startup ecosystems worldwide to assess the potential of different regions. By examining the 1,000 cities and 100 countries, we gain valuable insights into regional activity and emerging trends. Let’s explore some of the noteworthy regions and their characteristics.

Regional Insights

North America is the dominant startup region among the top 100 cities

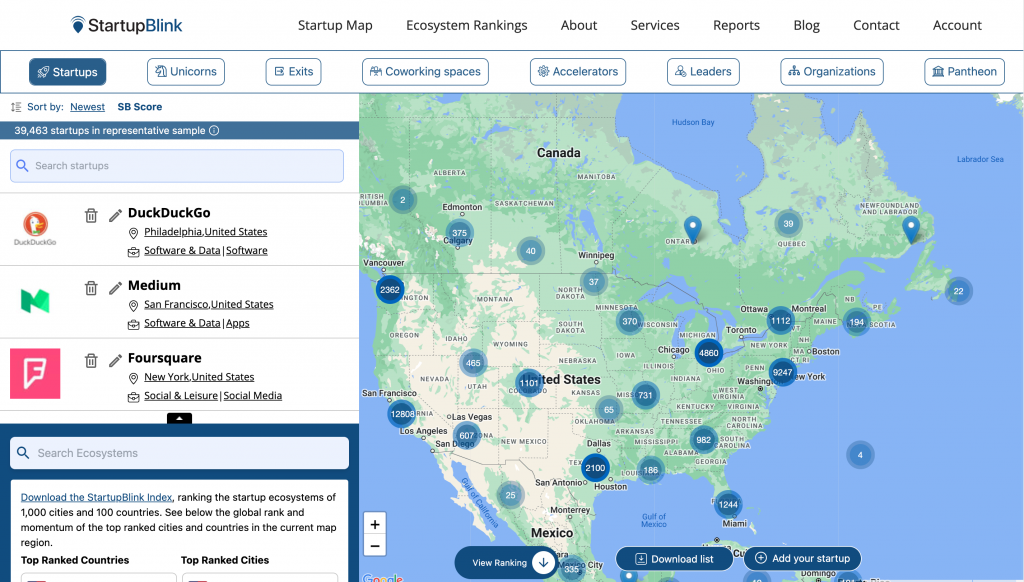

Gain full access to the StartupBlink map with StartupBlink Pro.

North America, encompassing the United States and Canada, continues to be a global powerhouse for startups. With vibrant entrepreneurial hubs like San Francisco, New York, Los Angeles, and Boston, this region offers a fertile ground for innovation and investment. Startups in North America benefit from a robust support system, access to capital, and a culture that celebrates risk-taking and disruptive ideas.

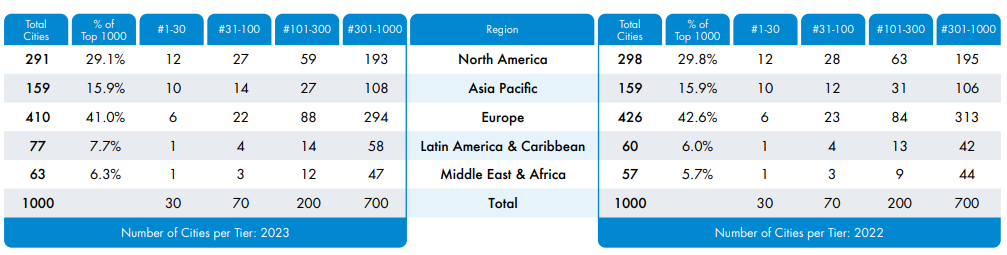

In terms of diversity in the global top 1,000, this year’s Index shows a small improvement, as the two dominant regions, North America and Europe, saw their combined share drop from 72.4% last year to 70.1% this year. We start with the momentum of North America, which includes ecosystems from only two countries: The United States and Canada. North America accounted for 29.8% of ranked cities last year and has kept its representation relatively stable, claiming 29.1% of the top 1,000 cities this year with similar distribution across all city ranking tiers.

It should be noted that although North America is not the region with the most cities in the top 1,000, it is by far the most dominant region among the top 100 cities, leading in both the number of cities ranked between 1-30, where it has 12 cities (40%), and cities ranked 31-100, where it has 27 cities (38.5%). By comparison, Europe, which leads in the number of cities in the rankings (41%), has only 6 cities in the top 30 (20%), and 22 cities ranked 31-100 (31.4%). Similarly, North America clearly dominates the top charts of all 11 ranked startup industries. The city of San Francisco is the undisputed leader in all ranked industries, and some of its key contenders, New York, Los Angeles, and Boston, demonstrate that North American ecosystems, particularly those in the US, are dominant hubs of global innovation.

Europe boasts the most cities in the global top 1,000

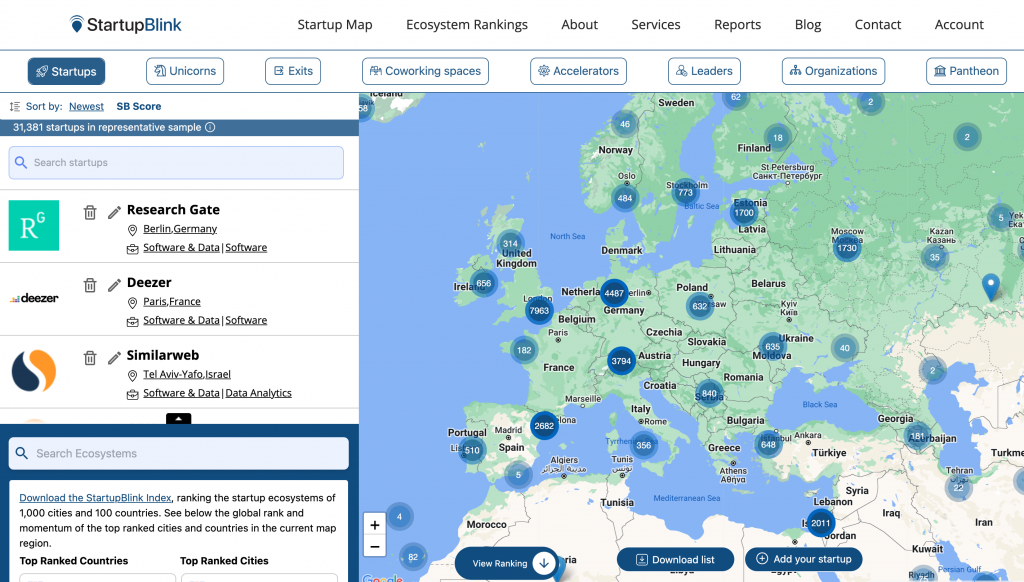

Gain full access to the StartupBlink map with StartupBlink Pro.

Europe boasts a diverse range of startup ecosystems, with numerous cities making their mark in the global top 1,000. From tech hubs like London, Berlin, and Stockholm to emerging startup scenes in Eastern Europe, the continent offers a wealth of opportunities for entrepreneurs and investors. However, challenges such as regulatory complexities and fragmented markets require concerted efforts from policymakers to foster a unified and supportive startup ecosystem across Europe.

As mentioned, the European region has the most cities in the global top 1,000, with 410 cities in 2023 (41%), compared to 426 cities (42.6%) in 2022. There has been a slight decrease of European cities ranked in the top 100 (28 cities compared to 29 cities last year). However, 88 European cities managed to solidify their status in the seed ecosystem stage ranked between 100-300, compared to 84 last year. Most of the value destruction was registered in the fragile tier of cities ranked 300-1000, where Europe now has 294 cities, compared to 313 last year. This might not be negative news, as increasing decentralization of ecosystems across the continent might not allow the leading European ecosystems to grow at the pace we witness in other regions with fewer cities but stronger hub concentration.

These numbers reveal the massive diversity of technological hubs in Europe, even though the momentum is slightly negative. But there are also positive trends on the continent: Out of the 45 countries ranked in the top 100, 26 improved their position in 2023, whereas 13 dropped (6 remained in the same position). Further, 175 ranked European cities improved their rankings (and 16 more cities joined the ranking for the first time), while 212 cities dropped in rank. This suggests that while there is much startup activity in the European region, it is still lagging behind other regions in realizing high-impact startup economies. Unlike North and South America, Europe does not share a common language, which might explain why startups find it more challenging to scale in Europe as compared to America.

Asia Pacific’s representation in the global 1,000 is on the rise

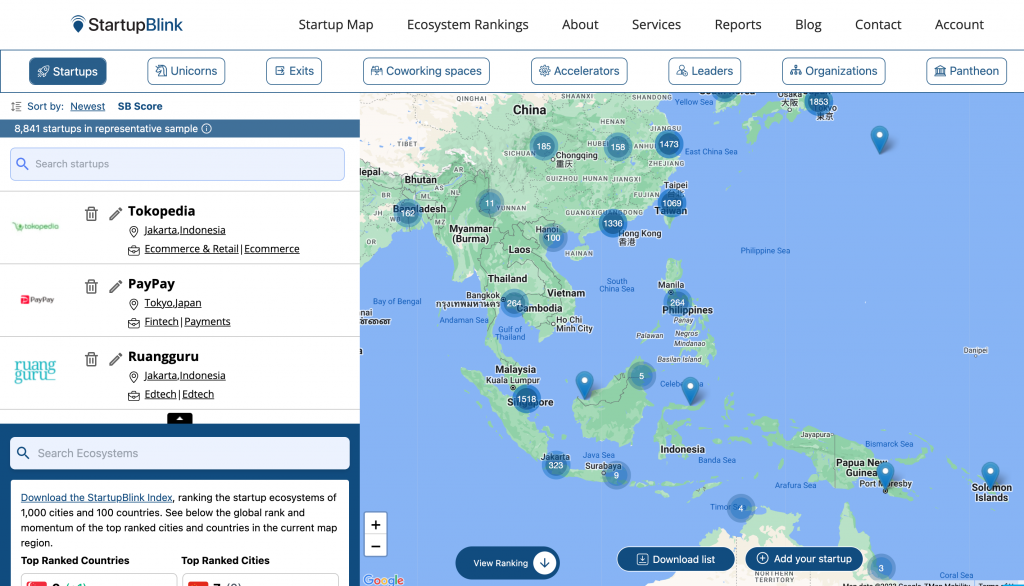

Gain full access to the StartupBlink map with StartupBlink Pro.

The Asia Pacific region has witnessed tremendous growth in startup activity, becoming a hotbed of innovation and entrepreneurial excellence. Countries such as China, India, Singapore, and Australia have emerged as major players, attracting startups and investors from around the world. The region’s large consumer markets, technological advancements, and government support have contributed to its rapid rise as a startup powerhouse.

The Asia-Pacific region continues to assert its dominance in the global startup landscape. In terms of diversity, the region maintained its representation in 19 countries among the top 1,000 cities. The region’s performance remains generally positive, with 10 countries improving their rankings and consolidating the area as a global leader in innovation. Notably, two Asian Pacific countries, Singapore and Australia, ranked in the top 10. A total of ten Asian Pacific countries ranked in the top 50, with four of them rising in the rankings. In the global top 100 cities, the region’s representation increased from 22 cities to 24, showing that the region is expanding its global reach. With 159 ranked ecosystems, the Asia-Pacific region sustains its position as a hotbed for startup activity, driven by factors such as technological advancements, government support, and a large consumer market.

Latin America & Caribbean region maintains its share among the top 100 cities globally

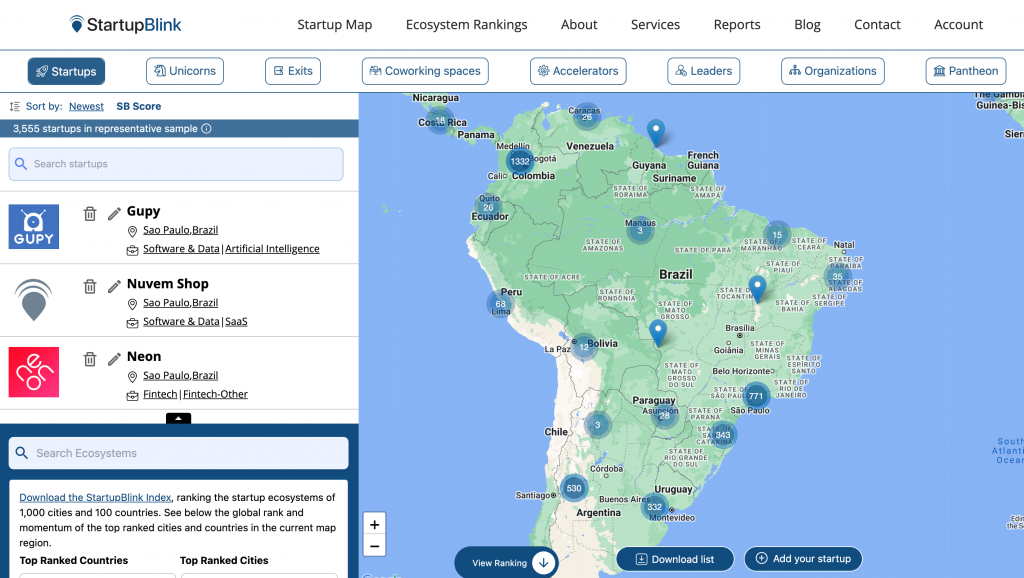

Gain full access to the StartupBlink map with StartupBlink Pro.

Latin America & Caribbean (LAC) is experiencing a dynamic and evolving startup landscape. Cities like Sao Paulo, Mexico City, and Buenos Aires are becoming prominent startup hubs, offering a blend of local talent, entrepreneurial spirit, and access to venture capital. However, the region faces challenges related to infrastructure, access to funding, and bureaucratic hurdles, requiring collaborative efforts from stakeholders to unlock its full potential.

Latin America & Caribbean boasted mixed results, as mature ecosystems expand while smaller ecosystems wither. In terms of diversity, LAC maintained its share among the top 1,000 cities at 7.7%. Appearances suggest stability since the number of LAC countries in the global top 100 remained the same as last year: 11. However, only four countries managed to increase their standing, with the rest showing a decline. On the city level, the region registered impressive growth and now has 77 cities ranked (7.7% out of the total cities) compared to 60 one year ago. This increase mainly arrived from 58 cities ranked between 300-1,000 compared to 42 last year, showing that more seed ecosystems are starting to emerge in the region. Latin America & Caribbean’s potential lies in fostering these emerging ecosystems and providing the necessary support to drive sustainable growth.

With Israel as the leading powerhouse, the number of ranked cities from Middle & East Africa is on the rise

The Middle East & Africa region is a promising frontier for startups, with several countries showcasing entrepreneurial growth and innovation. While Israel stands out as a startup powerhouse, countries like the United Arab Emirates, Nigeria, and Kenya are also making their mark. The region’s unique challenges, including political and economic instability, highlight the importance of supportive policies and investment in infrastructure to unlock the full potential of its startup ecosystems.

The Middle East & Africa region is experiencing notable growth and shows great potential for startups. At the country level, the region gained a newly ranked country (Uganda at the 96th spot) and has a total of 23 countries ranked in 2023. Yet, South Africa’s decline means that no African country is ranked among the global top 50. At the city level, the results are relatively positive for the region: in 2022, 57 cities in the global top 1,000 (5.7%) were from the Middle East & Africa; this year, the number is 63 (6.3%), 14 of which are from a single country, Israel. The region experienced net gains of 3 cities both in the 101-300 range and the 301-1,000 range. 33 of the cities in the region ranked in the global top 1,000 improved their rankings, while 20 decreased. This growth signifies the rising prominence of Middle Eastern and African cities as emerging innovation hubs.

Ecosystem Funding by Region

As the global startup ecosystem continues to thrive, understanding the regional distribution of funding provides valuable insights into the dynamics of entrepreneurial growth. In this section, we delve into funding trends across different regions, shedding light on the dominance of North America, the rise of Asia Pacific, the challenges faced by Europe, and the unique characteristics of the Middle East & Africa and Latin America & Caribbean regions.

North America is the startup region where most of the global funding flows

Despite a slight decline from the previous year’s 52%, North American startups maintain their prominent position by capturing an impressive 49.9% of the global funding. This statistic highlights the region’s enduring dominance in the startup landscape, even though its share in terms of startup activity may be comparatively lower.

Asia Pacific Surges Ahead

The Asia Pacific region exhibits strong performance, securing 24.5% of global startup funding. Notably, over 60% of the regional investment is concentrated in two powerhouses: India and China. This highlights their growing prominence in shaping the global startup ecosystem.

Europe’s Growth and Challenges

Europe, with 41% of the top 1,000 startup ecosystems, witnesses a slight increase in its share of funding from 18.3% to 19.7%. However, despite its diverse and active startup scene, Europe lags behind North America and Asia Pacific in attracting significant investment, with only 19.7% flowing into the region.

Funding to Africa & Middle East is on the Rise

The Africa & Middle East region experiences a notable boost in funding, with the percentage rising to 3.7% from last year’s 2.5%. Israel stands out as a dominant force, with a staggering 53.3% of the funding for the Middle East & Africa region flowing into Israeli startups. This highlights Israel’s prowess in fostering innovation and attracting investment.

Latin America & Caribbean is the startup region with the lowest amount of funding

Latin America & Caribbean receive the lowest amount of funding in 2023, capturing only 2.2% of the global total compared to close to 3% in the previous year. However, Brazil, Mexico, and Colombia stand out within the region, capturing over 70% of the funding. This indicates a concentration of resources in a few key countries.

Conclusion

In conclusion, the Global Startup Ecosystem Index 2023 shows that North America is the most dominant region, capturing 49.9% of global funding with the highest number of cities in the global top 100. Asia Pacific is emerging as a hub of innovation, securing 24.5% of funding, while Europe shows the highest amount of startup activity but faces challenges in attracting significant investment at the level of Asia Pacific and North America. The Africa & Middle East region is experiencing a notable boost in funding, yet the region is still the least dominant in terms of startup activity. Last but not least, the Latin America & Caribbean region is still far from catching up with other regions in terms of startup funding.

About Us:

StartupBlink is the world’s most comprehensive startup ecosystem map and research center, working with over 100 government entities worldwide. StartupBlink’s global startup ecosystem map has tens of thousands of registered startups, coworking spaces, and accelerators, creating a robust sample of innovation globally.

Our Partners: