Abstract

This report expands on the findings of StartupBlink’s Global Startup Ecosystem Index 2022 and showcases the state of the Social and Leisure startup industry. It is an in-depth look into the top 30 cities for Social & Leisure Startups in 2022, as well as the notable startups, unicorns, pantheons, and exits. The Social & Leisure industry represents the third largest industry for startups, having a considerable size of startups and unicorns.

Social & Leisure Industry at a Glance: Top Insights

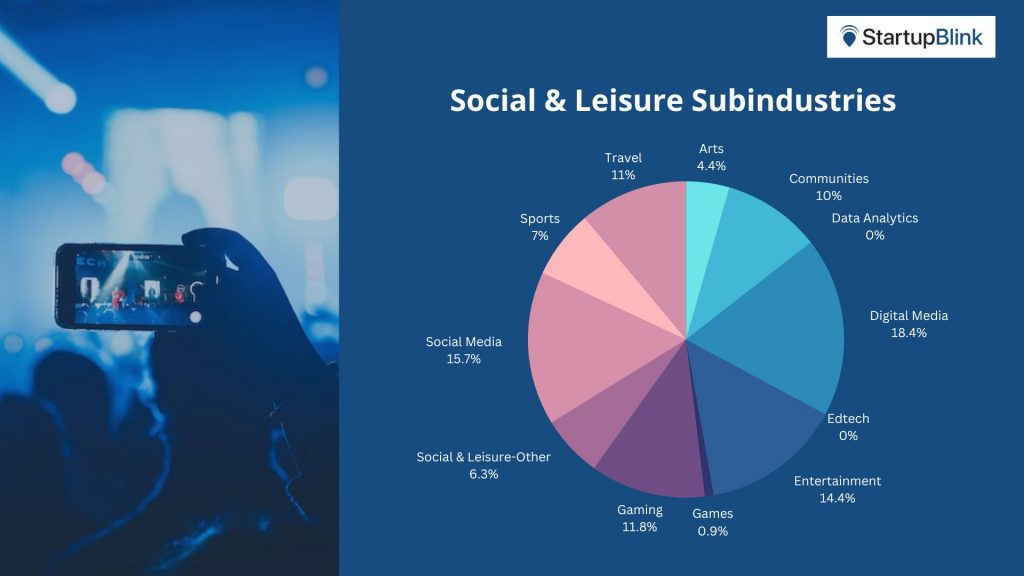

➡️In 2022, Social & Leisure was the third largest industry in the StartupBlink’s GSEI2022, with 10.4% of our sampled startups. On the StartupBlink Ecosystem Map, we have identified 10 subindustries with the largest being Digital Media (18.4%), followed by Social Media (14.8%) and Entertainment (14.3%).

➡️Unlike the previous industry reports published by StartupBlink, the United States’ dominance is less prominent in the Social & Leisure industry. Only 9 out of 30 destinations are occupied by the United States. The top 7 cities in rank order are San Francisco, New York, London, Los Angeles, Beijing, Stockholm, Sweden, and Tel Aviv.

➡️ The Unicorn count in our sample database for this industry is 30, which boasts 2.9% of the total sampled unicorns.

➡️ From 2021 to 2022, Dallas-Fort Worth, Amsterdam, Shenzen, and Istanbul increased their industry rankings substantially.

Ranking the top 30 Cities for Social & Leisure

As expected, San Francisco is at the top of the charts again for the Social & Leisure Industry, followed by New York and London. The top 7 cities in rank order are San Francisco, New York, London, Los Angeles, Beijing, Stockholm, and Tel Aviv. There are some recognizable changes in the top 7, compared to 2022.

Firstly, London managed to climb up 3 spots and it is now the second leading city for the Social & Leisure Industry. Tel Aviv and Stockholm are the two new cities in the top 7 by climbing 4 and 2 spots respectively. New Delhi and Boston Area could not keep up with their performance in the Social & Leisure Industry and lost their position in the top 7, now ranking 8th and 11th.

An important highlight from the chart is the fact that cities like London, Los Angeles, and Beijing are closing the score gap with San Francisco. From 2021 to 2022, London decreased the gap with San Francisco from 574% in 2021 to 174%. Similarly, Los Angeles is closing the gap with San Francisco from 379% to 240% and Beijing from 383% to 256%.

Portland, Raleigh Durham, Istanbul, and Boulder are overperforming compared to their general rankings in StartupBlink’s GSEI2022. These cities are performing 45, 22, 40, and 26 spots higher in the Social & Leisure Industry rankings. In contrast, Seattle, Sao Paulo, and Shenzen are not able to expand their performance in the general rankings to Social & Leisure rankings. The cities are ranking 14, 11, and 10 spots lower respectively.

Dallas-Fort Worth showed a significant score increase of 291,92% and jumped from 46th to 16th position in the industry rankings. Amsterdam has a noticeable acceleration in 2022 as its total score increased by 247,57% and the city rankings have been shifted from the 39th position to the 15th position. Shenzhen also climbed to the 28th position in 2022 from the 63rd position and showed a 231,08% increase in its total score. Istanbul is another blossoming startup ecosystem in the Social & Leisure rankings, compared to last year, the city has improved its total score by 202.3% in 2022 and shifted from the 57th spot to the 26th spot.

In comparison to 2021, Warsaw, Sydney, and Philadelphia‘s rankings have dropped significantly, so they are no longer in the Top 30 Cities for the Social & Leisure Industry. Austin, Seattle, and Sao Paulo managed to stay among the Top 30, however, they experienced a drop in 10, 8, and 7 spots.

Social & Leisure Pantheon Members in 2022

Pantheon members is a category coined by StartupBlink which includes companies or organizations that are no longer a startup or a unicorn, but that still have a substantial impact on their startup ecosystem and its brand. These Pantheons are categorized into three tiers depending on their impact and quality. Below are the pantheon members that are making a notable impact in the Social & Leisure industry:

Udemy is an e-learning platform that helps students, companies, and governments gain access to the knowledge required to improve themselves.

Airbnb is a platform for arranging lodging and homestays with over 150 million guests and 4 million hosts worldwide.

Spotify is a music streaming platform that enables listeners to reach music with the device of their choice.

Supercell is a mobile game developer based in Helsinki, Finland, with offices in San Francisco, Seoul, and Shanghai. Some well-known games include Brawl Stars, Clash Royale, Boom Beach, and Clash of Clans.

Crunchbase is the provider of private-company prospecting and research solutions with 70 million users.

Founded in 2006, Techstars is a worldwide network that helps entrepreneurs to connect with investors and corporations.

Tripadvisor, the world’s largest travel guidance platform helps users with planning to book to take a trip.

Badoo is a social network focused on dating, allowing users to chat, make friends, and share interests.

WeChat is an all-in-one communication platform, that connects people services, and businesses in one platform.

Founded in 2008, Stack Overflow’s public platform is used by people who code to learn and share their knowledge.

Social & Leisure Unicorns in 2022

Unicorns are startups that reached a valuation of one billion dollars or above. Below are the highest-ranked Social & Leisure unicorns from the StartupBlink database.

Scopely is a mobile-first video game developer and publisher, building the next generation of consumer mobile experiences.

Kajabi is a SaaS platform that enables entrepreneurs and creators to easily create, publish and sell digital products and membership sites.

HoneyBook is a client management software targeting small businesses.

BlaBlaCar connects drivers with empty seats to passengers traveling the same way.

Traveloka is a travel booking website and app for domestic and international destinations.

Strava is a platform tracking physical exercise and connects users with other athletes from all over the world.

Yixia provides a mobile platform for sharing short videos.

TravelPerk is a travel platform that provides travel and expense management services for business travelers.

Epic Games is an electronic game development company.

TripActions is an app-based travel management company for businesses.

Social & Leisure Exits in 2022

Exit for a startup occurs when the founder sells the company’s ownership to an investor or another company. It is a strategy for many startups that have been decided on since their establishment. Here are the top exits in the Social & Leisure Industry based on the StartupBlink database:

DraftKings is a sports-oriented skill gaming company. Their core products are currently in the short-format Fantasy Sports space: DraftKings.com enables users to enter daily and weekly fantasy sports–related contests and win money.

Airbnb is a platform for arranging lodging and home stays with over 150 million guests and 4 million hosts worldwide.

Z-Business was built to help businesses launch and scale any subscription service. Its solutions enable users to design pricing and packaging, start taking quotes and placing orders, automate billing and payments, and keep tabs on their financials on a cloud platform.

Spotify is a music streaming platform that enables listeners to reach music with the device of their choice.

FanDuel offers fantasy sports with daily games for real money.

Bluehole is a South Korean-based video game developing company..

Vacasa is an online platform featuring rental homes supported by 3D tours and AI-driven tools.

Kuaishou is a platform for sharing short videos and live streams powered by big data and AI technology.

Playtika brings art together with science to bring the most engaging and fully customized game experiences.

Agora.io is a real-time engagement platform for meaningful human connections.

Notable Social & Leisure Startups

Disqus is a commenting platform that enables websites to build active communities. Communities powered by Disqus are connected through a shared network of users and discussion.

LINE is a mobile messenger app, that enables users to connect through texts, images, video, and audio and VoIP conversations and video conferences.

StockTwits is a financial communications platform for the financial and investing community.

A Malaysian indie game development studio. In addition to game development, they also help corporations to digitize their businesses.

Ilovepdf is a website that provides free online tools to join PDF, separate PDF, compress PDF, convert Office documents to PDF, PDF to JPG and JPG to PDF with no installation needed.

Twoo is a social platform to meet new people. Twoo is available in over 200 countries and in 38 languages.

BoredPanda is an art, design, and photography community for creative people

JustWatch is a streaming search engine, helping users to find out where to watch movies and tv shows legally online with JustWatch.

OkCupid is a dating site that matches users by using quizzes and multiple-choice questions.

Hotstar operates an online video streaming platform, since 2000.

Methodology

To ensure that the rankings are as accurate as possible, we have based our algorithm on objective, quantifiable data that can be comparatively measured across regions, countries, and cities. We refrained from using subjective tools such as surveys and interviews, and instead utilized data that was either accumulated directly from the StartupBlink map or has arrived from integration with a reliable global data partner. We allow as few assumptions as possible regarding cause and effect and focus on one thing: measuring results. We avoid relying on any theoretical models assuming the causes of success for startup ecosystems.

Every year our algorithm is more accurate, and it should be noted that the momentum change of each ecosystem is not only influenced by its achievements over the last year, but also by these algorithm improvements. We have been sampling startup ecosystem data on the curated and interactive StartupBlink Global Map, which enables us to test and perfect our algorithm based on vast sets of data. We estimate that the core map dataset has a representative sample covering 10-15% of total relevant entities in global startup ecosystems. In addition, hundreds of thousands of entities and data integrations are taken into account via our global data partners. Each location’s final score is based on the exact same algorithm. However, we are aware that our sample size fluctuates depending on location and data sourcing. Our only intervention in the score is discounting locations where we determined that the sample size of the entities is higher than average. In order to solve issues with lower than average sample size, we have partnered with approximately 100 Ecosystem Partners, most of which are Government agencies, many of them in locations where our data is limited. We offer all governments administrative access to curate the dataset of their ecosystems, at no cost, granting them complimentary access. On our rankings with Unicorns and Exits, we take into account the valuation of each startup and add some special filters to exclude government entities and corporate spin-offs.

The Methodology used in the 11 industry rankings, including Software and Data, is identical to the algorithm of the global rankings, while taking into account the startup database of each industry. However, the fintech Industry rankings are built on an official Fintech Ecosystem Portal: Findexable’s Global Fintech Map, which includes deeper algorithm changes that are customized according to the specific characteristics of the fintech industry.

Our Data Partners: