StartupBlink has just published the Startup Ecosystem Rankings Report 2019 that now ranks 1,000 cities and 100 countries, making it the most comprehensive startup ecosystem report ever published. The Startup Ecosystem Rankings Report 2019 by StartupBlink presents the latest trends and developments in the global startup ecosystem scene that we will cover in this article. To analyse key findings that are most interesting on a global or regional level, we will begin with country rankings and move on to take a closer look at cities.

Country Rankings Insights

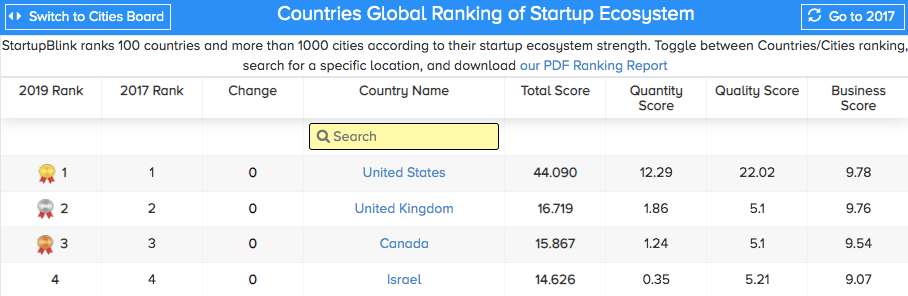

Since 2017, there has been no change in rankings for the first 4 countries (USA, UK, Canada, Israel). These nations seem to form a league of their own in the startup world, maintaining their standings and huge score gap in relation to other countries, even though both the data and algorithm have changed. In short, we can officially refer to these countries as the startup ecosystem “Big 4” club.

It should be noted, however, that the “Big 4” is led by one massively dominant country: the USA. No other country even comes close to challenging US status as the global leader of startup ecosystems, which is also evident in the number of ranked US cities. More than 400 cities, or over 40% of the total number of ranked cities on the map, are from the USA. For comparison, no other country has more than 50 cities in the rankings, so the difference is striking. The countries that follow at spots 5 to 10 are very close to each other on total score, making the difference between them relatively small.

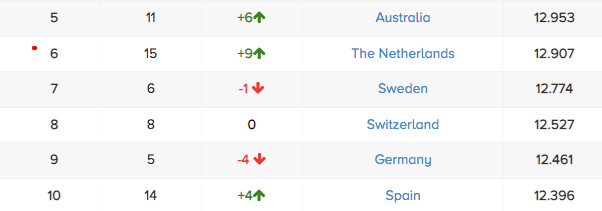

The first notable changes in country rankings begin with Australia, which now ranks number 5 globally (Canva becoming a unicorn was helpful), and the Netherlands, with an impressive jump of 9 spots to now be ranked 6th. This also spotlights the dominance of native English speaking countries, which only intensifies in the current report. Four of the top Five ranked countries are native English speaking countries (USA, United Kingdom, Canada, Australia), and it’s no coincidence that Israel (4th), The Netherlands (6th), and Sweden (7th) are non-native speaking English countries with very high English proficiency. Based on that, it seems that if countries want their ecosystems to improve, upgrading the English-speaking level of their population is essential.

A few additional changes in the top 10 countries rankings include Germany sliding 4 spots to 9th, and Spain increasing 4 spots to 10th.

Our Rankings continue to indicate that small countries can make it big. 8 of the top ranked 20 countries have less than 10 million inhabitants (Israel, Sweden, Switzerland, Finland, Estonia, Ireland, Denmark, Lithuania).

Here are some interesting facts about regional leaders around the world:

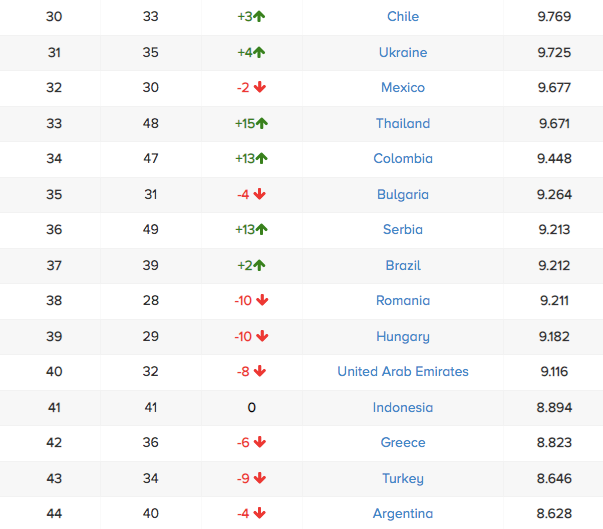

In the Americas, there remains a massive gap between the USA and Canada (1st and 3rd) compared to Latin American countries. Chile (ranked 30th) is the new hot ecosystem in Latin America, switching places with Mexico (Now ranked 32nd). Colombia, another rising star, is now ranked 34th globally and 3rd in Latin America. Brazil (37th) with a slight increase and Argentina (44th) with a slight decrease both continue to underperform, considering the scope of their potential.

The gap is even more striking in the Middle East; Israel is ranked 4th, while it’s closest follower, the United Arab Emirates, dropped 8 spots to 40th.

Europe continues to fare well, with 19 countries (including Russia and the UK) in the top 30 countries club. Other than the Netherlands impressive rise to the 6th location, it is worth mentioning Finland with a notable jump of 7 spots to 12th, Denmark losing 9 spots to the 16th location, Serbia’s impressive 13 spot jump to 36th, and Luxemburg’s climb of 12 spots to 53rd. We identify a strong presence of CEE (Central and Eastern European) countries, affecting 5 out of the top 25 countries. All CEE countries either gained or maintained their ranking despite intensifying competition from other emerging economies.

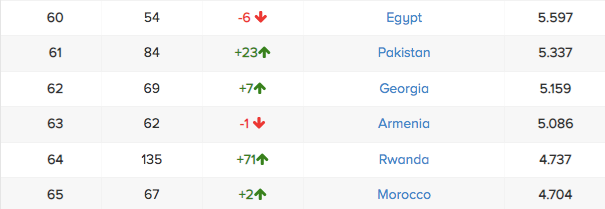

Some of Asia-Pacific top-ranked countries lost momentum in the 2019 rankings. Singapore is no longer ranked 1st in Asia-Pacific, dropping 11 spots to 21st and falling out of the top 20 club. China is also out of the top 20, now ranked at 27th. This led to concern that our ranking algorithm did not accurately capture China’s real startup activity, and we discuss this in detail in the full report. Luckily, there is one Asian country making a swift climb in the rankings: India has climbed 20 spots and is now ranked 17th. More good news arrive from several Asian countries, namely Thailand (33rd), the Philippines (54th), Pakistan (61th), and Bangladesh (87th), all increasing their rankings by 15 spots or more. New Zealand is also gathering momentum, increasing its ranking by 26 spots.

As for Africa, the results are mixed. No country has made it to the top 50 this time since South Africa lost momentum and dropped 13 places to rank 51. However, Kenya (52nd), Nigeria (56th) and Egypt (60th) all maintained their ranks in the top 60 list. The big news is coming out of Rwanda, the phoenix of Africa has soared up the rankings and is now resting at 64th. If this continues, we might see Rwanda as a new African leader in the top 50, what an inspiring story!

Download our report to read insights about all 100 countries ranked.

Cities Rankings Insights

San Francisco strongly maintains its leading spot with a total score 5 times higher than the ecosystem, New York. The big apple, is also maintaining a large margin of more than double the total score than the third-ranked ecosystem, London. Los Angeles remains in spot 4 but is now closely followed by Boston, which climbed one spot and is now ranked 5th. Tel Aviv managed to advance one spot to 6th, while Berlin dropped two spots and is now ranked 7th. Chicago and Seattle maintained their exact location from the last rankings (8th and 9th), while we have a new top ten city, the mega hub of Moscow, increasing 4 spots in the rankings. Bangalore, ranked 11th, has made an even bigger jump of 10 spots since the last rankings. One more city that is now flying high; Tokyo jumped 15 locations to 14th.

An interesting point to discuss is the quantity of cities from each country in the top 100. This shows diversification of hubs in each country, instead of a single giant hub. In the top 100 cities, there are 29 US cities, a real show of dominance. However, the UK is ranked 2nd globally and still only has 2 cities in the top 100. Canada boasts 5 cities in the top 100 list (congratulations to new entrants, Ottawa and Edmonton), which makes us quite optimistic about its future, while Israel now has two cities in the top 100 cities list, with Jerusalem rising the ranks. Australia has 3 cities in the top 100 (Brisbane entering for the first time), while Germany shows a great result of 5 cities (Cologne just made it as well). The Netherlands and Sweden are the only two top 10 ranked countries with only one city in the top 100 list, Spain has 2 cities (Barcelona and Madrid as before), and Switzerland has two top 100 cities as well (Congratulations to Lausanne, a new top 100 hub).

There is a stronger showing by Latin American cities, with 9 cities in the top 100, compared to only 4 cities in 2017 (Sao Paulo 23rd, Mexico City 47th, Buenos Aires 48th, Bogota 52nd, Rio de Janeiro 64th, Lima 68th, Belo Horizonte 70th, Monterrey 81th, Guadalajara 90th). Developing ecosystems are on the rise anywhere.

Download the Startup Ecosystem Rankings Report 2019 by StartupBlink

The Startup Ecosystem Rankings Report 2019 by StartupBlink can be downloaded via the following link. In the same page, the ranking tables appear, where you can switch between countries and cities rankings, and search for specific locations.